According to Canalys’ latest data, global shipments of tablets reached 33 million in the third quarter of 2023, marking a decline.

annual rate of 7%.

The tablet market is at a turning point. As every year, at this time, manufacturers hope for a revival of the market before the crucial end of the annual holiday period.

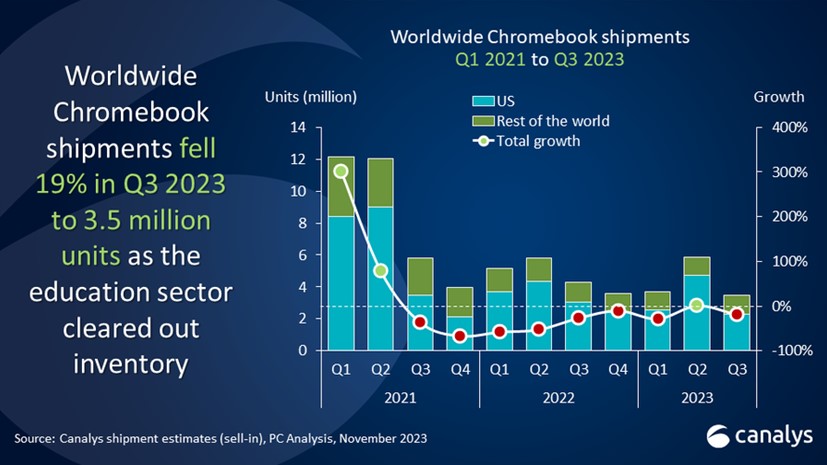

At the same time, Chromebook shipments fell 19% to 3.5 million in the third quarter of 2023. This is because a large portion of back-to-school inventory was sold through the channel.

“As inventories stabilize, tablet shipments begin to increase sequentially”said Himani Mukka, research director at Canalys. “This bodes well for the coming year-end holidays, where continued discounts and the launch of new products should allow the market to return to annual growth”.

GenAI

Preferences have shifted to high-end devices with larger screens, influenced by changing user needs for productivity and content consumption.

Additionally, tablet vendors need to start prioritizing the integration of generative AI capabilities into their devices to maintain a competitive edge.

Major players Apple and Samsung have already signaled plans to integrate AI experiences into their hardware. As PCs and smartphones prepare for significant advances in device AI, vendors must ensure their tablets continue to deliver consistent user experiences and maintain interoperability throughout the device ecosystem.

Smartphone manufacturers are making progress in the tablet market, especially Chinese vendors with innovative offerings and competitive prices.

In the third quarter of 2023, Huawei and Xiaomi surpassed Amazon in the seller ranks. Apple is in first place, with 12.5 million iPads shipped, or 38% market share in the third quarter.

Chromebook Plus

Second place Samsung shipped 6.2 million tablets, down 6 percent, while Lenovo shipped 2.6 million tablets, maintaining its third place. Huawei and Xiaomi took fourth and fifth place, respectively, with the latter entering the top 5 with the highest growth among major vendors.

As discussed at the beginning of this article, the global Chromebook market saw a moderate decline in the third quarter of 2023 after a strong back-to-school season in the previous quarter.

Acer reclaimed the top spot in Chromebook shipments with a relatively small 16% drop from the second quarter, but shipments still fell 17% year over year.

Meanwhile, second-placed HP faced a bigger sequential decline of 57% after holding the top spot. Dell retained its third place position, with its third-quarter shipments roughly matching HP’s. Lenovo and Asus occupy the bottom five places in the ranking.

“Early this year, OEMs rushed to pre-build models before ChromeOS license fees increased and to take advantage of the latest round of funding from the US government’s Emergency Connectivity Fund. But, the result was a sharp decline in the third quarter”notes Kieren Jessop, analyst at Canalys.

Google recently announced Chromebook Plus laptops that have twice the performance of standard Chromebooks, but are still reasonably priced for the low end.

“They will likely do better than their predecessors in the small business segment. But they face stiff competition as the PC industry’s latest obsession with AI-enabled devices could prove difficult for Chromebooks”said Kieren Jessop, an analyst at Canalys.