As the French construction economy declines, what are its prospects for development? Especially in terms of sustainability? The point in a study by McKinsey & Company.

It is a project that concerns France like other countries, but also construction like many other sectors: the environmental transition.

” The Fit for 55 package, adopted in 2021, determines the climate goals of the member states of the European Union. It constitutes a more ambitious variation than that of the international goal, because this orientation requires a reduction of the Member States’ emissions by 55% by 2030, and carbon neutrality in 2050. », remembers McKinsey & Company in the latest study.

The consulting firm thus investigates the different challenges and levers of this environmental transition on the scale of French construction. ” The ability of the engineering and construction sector to delivering projects on time and on budget is essential to achieving decarbonisation targets by 2050 : it is especially about being able to complete all the necessary projects on time “, reads the McKinsey & Company report.

“ Succeeding in this challenge will also have a direct economic impact until 2030 estimated at more than 1% of GDP and an indirect economic impact of more than 10% of GDP, or more than 3 million jobs in France. To achieve this goal and attract the necessary investments, the construction sector in France must address four major structural challenges. », adds the consulting firm.

A lack of work that risks widening

And, unsurprisingly, these structural challenges are the same ones cited for years. First of all the lack of work unprecedented » in the construction sector. According to figures from McKinsey & Company, more than 26,000 positions were filled in the 3rd quarter of 2023. A vacancy that is fivefold compared to that observed in Q3 2016.” This is the case for essential roles, such as work supervisors, planners, welders (especially for new industrial sites), craftsmen (for energy renewal) or even professions directly linked to the digital. », It is specified in the report.

The shortage is expected to grow, according to estimates by France Travail, according to which more than 20% of the current workforce (470,000 people) will retire by 2030. If young workers should make up for these departures, a talent gap is apprehended in the report.

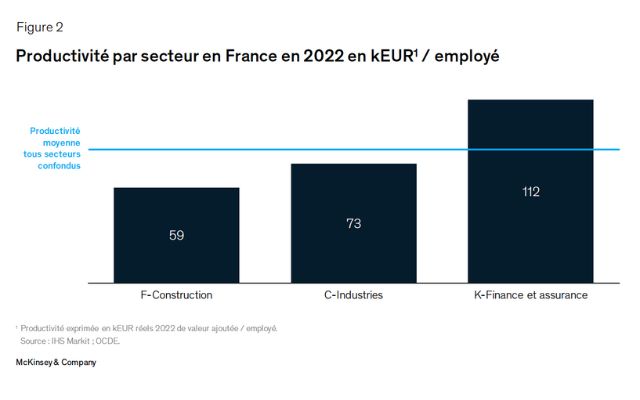

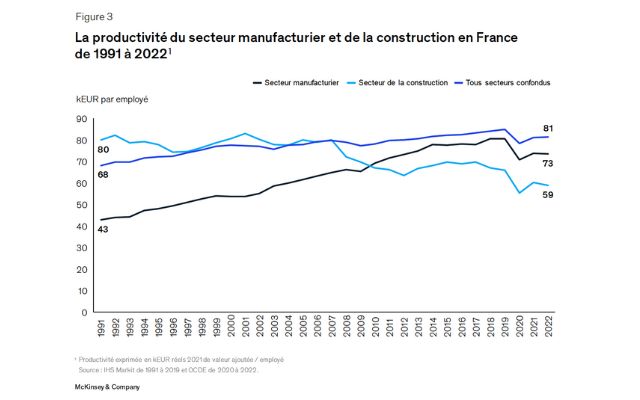

Added to this lack of skills is low productivity., that is the ratio between GDP creation and working hours. ” The gap compared to the average of the French economy is significant: productivity in the construction sector is actually estimated at €59,000 of added value per employee per yearcompared to €81,000 on average for the French economy, all sectors combined », mentions McKinsey & Company.

Productivity decreased by 1% per year between 1991 and 2019 in this field, while that of the entire French economy increased by 0.6%. And this despite digital transformations, because other obstacles are regrettable in this position, including the training and qualification of employees.

An increase in prices that inhibits innovation

On the contrary, French construction exceeds national averages in terms of inflation. In the area, material prices jumped 17% during the period from January 2019 to June 2023, compared to a +12% national average, all sectors combined.

” Although the prices of some materials, such as steel, have fallen compared to their peaks in 2022, they still remain significantly higher today compared to the prices recorded at the beginning of 2020 (+20% for ‘steel’). This is linked to global supply chain disruptions and rising energy and raw material costs. Even if this tends to stabilize, we believe that the increase could remain significantdue to energy prices, which should continue to weigh heavily », develop the authors of the report.

The result is narrower margins between companies in the sectors that fear a bleak economic outlook. This is proven by their returns in the last situations of the CAPEB and the FFB. ” This erosion of profitability is problematic: it limits the ability of construction players to innovate as well as implement their transformation plans, and impacts their valuation. », underlines McKinsey & Company.

Which could slow down the environmental transition of construction. This vast project focuses on two important areas: the construction of new assets and energy renewal.

Better organizational and financial optimization for green construction

McKinsey & Company, however, identified different levers to support the environmental transition in construction. The first: modernization of courses and processes. Not only through digital technology, but also through management and work methods as well as alternative career development perspectives.

“ This implies considering non-traditional talents, strengthening partnerships with external parties and rethinking collaboration with education systems. Finally, reinventing the employee experience through non-linear careers. Beyond promotions, players in the sector can further expand the spectrum of methods of updating and increasing experience, such as skill badges, executive mentoring or special projects. moreover, barriers must be removed, such as arduous working conditions or lack of diversity », list McKinsey & Company.

The report also emphasizes business productivity. Digital should make its contribution, with the use of collaborative platforms or artificial intelligence tools, saving time and resources on construction sites. Because financial profitability has its role in the environmental transition of construction. Among the paths mentioned in the study, McKinsey & Company mentions optimization of supply costs. ” With this method, a player in the chemical industry, in collaboration with engineering, managed to optimize the storage area of its raw materials and save more than 100 million euros in a total project of a billion euros. “, explains the consulting firm.

This supply chain should also become more reliable.using alternative suppliers, indexing sales prices to inflation, grouping expenses, reducing one-time purchases through planning, etc.

Next comes collaboration between stakeholders. “ Not only do these contracts make it possible to better distribute risks between stakeholders, which is essential in inflationary periods, but also the McKinsey Global Institute study shows that cost/time efficiency is generally improved by 15 to 20% compared to more traditional contracts “, we learn in the report.

And the decarbonisation of industry in all this?

Finally, the last axis and not the least: decarbonisation of industry. On the matter, McKinsey & Company recommends ” deep development of the collective and individual habits of actors in the value chain and the ecosystem “. This applies equally to legislators, customers, suppliers, design offices and businesses.

“ The construction ecosystem in France faces a unique opportunity to enable and accelerate the environmental transition at a controlled cost for the community, thus giving a competitive advantage to the country. For this, the transformation of this industry – little digitized and productive – is essential. The impact in a game has never been greater. All players in the ecosystem have a key role to play in this unprecedented transformation and must accelerate their mobilization », concludes McKinsey & Company.